Business strategy has always been premised on assumptions about technology, those assumptions are changing, and this will drive us to a different concept of what we mean by business strategy. – Phillip Evans

In his talk at TED Phillip Evans argues why digital is transforming business strategy and business(1). And especially which forces are at work creating what we today perceive as asymmetric competition(2) and mutating industries. (3)

[ted id=1938]

Business strategy is built around Porter’s idea of value chains (4):

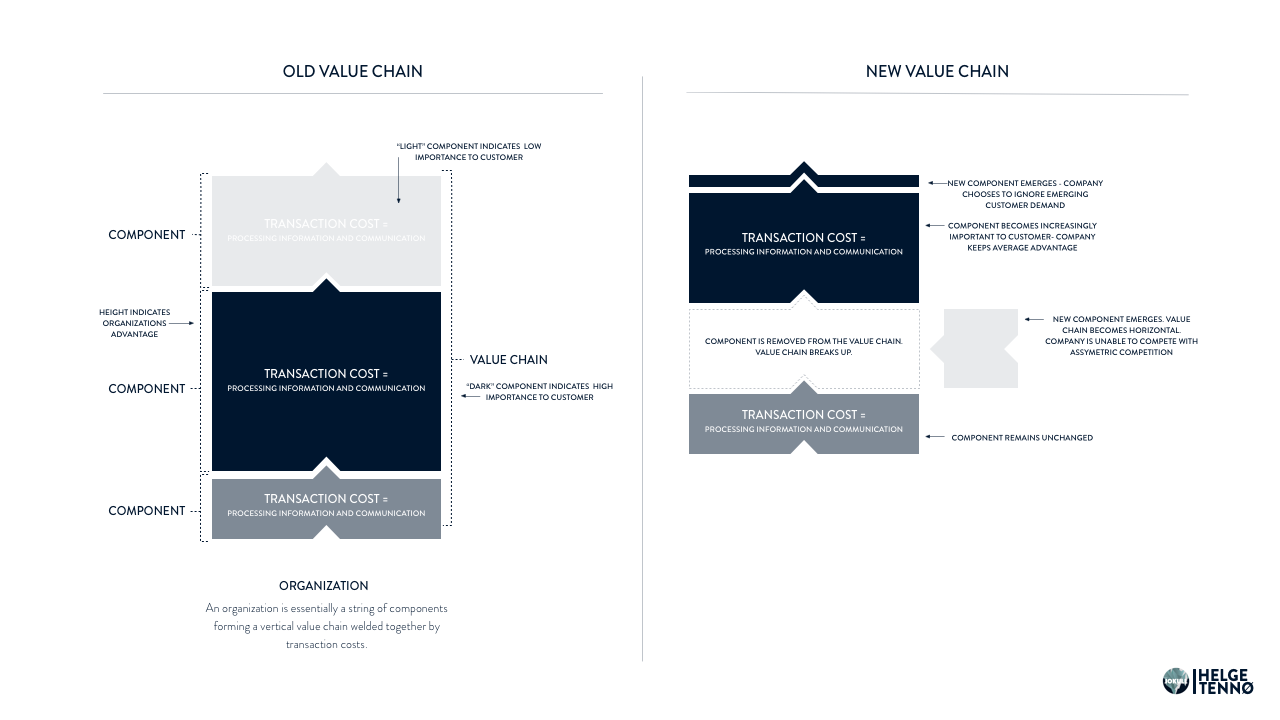

An organization is essentially a string of components forming a vertical value chain welded together by transaction costs.

A business’ competitive advantage is the sum or the average of its transaction costs. Companies usually wield large advantages in some components and are lagging in others.

business strategy_value chains_PDF

Companies are founded on the idea of a sustainable competitive advantage (4), seeing continued improvement in efficiency and standardization as a main ingredient in order to lower transaction costs in chosen components (5).

And this is why digital is carving out a new business landscape:

With digitization we can achieve zero marginal cost in some components – meaning that the transactional costs plummet to a level where there is less or nothing to economize on (zero marginal cost meaning that the cost of producing more than one instance is essentially zero(6)).

Evans argues that when certain components in the value chain plummet it can change the rules of the game for an entire industry – because it breaks up both the welding and usually (but not always) the entire value chain and allows for new competitive advantages and new value chains to take root – especially if the component that did plummet has been protecting the industry from outside competition.

This is comparable to the theory of disruption where Clayton Christensen argues that an industry is ripe for disruption when its core technology is stretchable

Psychosocial History viagra generic the time) Most times.

. “Its core technology” being a component in the value chain essential to the nature, protection or capitalization of the industry. (7)

Evans uses the example of the encyclopedia industry; collapsing as distribution and sales components imploded.

Christensen uses the example of education. A teacher is a technology, and was not stretchable in 2000, and therefore not ripe for disruption. But, six years later video-online-education makes teachers highly scalable and the industry is ripe for disruption.

“The basic story here is that what used to be vertically integrated, oligopolistic competition among essentially similar kinds of competitors is evolving, by one means or another, from a vertical structure to a horizontal one. Why is that happening? It’s happening because transaction costs are plummeting … The plummeting of transaction costs weakens the glue that holds value chains together, and allows them to separate.” – Phillip Evans

The second thing, which is outside Evans scope for his TED Talk is the customers preference in regard to which components are the most valuable. Assuming that the customer holds the key to which components are most important when accumulating the competitive advantage – the weight of a component is shifting with people changing their demands and their priorities (as a consequence of slow social change). What used to be an important component; wielding much weight to the accumulated competitive advantage – is no longer important. While other or even brand new components are taking center stage. (Tom Goodwin argues that the customer interface is such a component, wielding the largest weight for some industries going forward (8))

One of my favorite examples of this is referencing two fertilizer companies. One of them insisting that their expertise in producing fertilizer is world class – and the sequence of components enabling superior quality of the product are the most important operations in the value chain to the customers. While the competing company argues that farmers (the customers) don’t care about fertilizers, they care about getting up each morning doing what they can to get as much back from what they put in as possible. And they help the farmers with this through sensors, technology and software – every day.

The second company argues that; in the farmers mind, the fertilizer itself becomes infrastructure and less important, while the ability to assist the farmer every day – figuring out where, when, with what and how much to fertilize becomes a new component that customers values highly, and which didn’t exist ten years ago.

The first company is stuck investing in the traditionally most important components, which are now decreasing in value in customers’ mind. While the second company invests in components that customers are shifting towards.

Digital is creating disruption because it is leading to the decreasing or increasing value of certain components in a value chain. Shifting what has traditionally protected industries from internal and external forces. But now, as value chains weaken, switch or detach – through the internetification of communication (and soon energy and transportation (6)) new value chains take form, redistributing weight in existing industries or mutating existing industries into new value chains.

(1). How Data Will Transform Business, Phillip Evans on TED, http://bit.ly/1KVkM9W

(2). 5 Customer Gaps, Helge Tennø, http://bit.ly/1MnZe68

(3). Creating Value In The Age Of Distributed Capitalism, Shoshana Zuboff, http://bit.ly/1g1sUqg

(4). Value Chains, http://bit.ly/1KpyDag

(4). The End of Competitive Advantage, Rita McGrath, http://bit.ly/1F84mWK

(5). Design Flaws Within Organizations, Shoshana Zuboff – http://bit.ly/1GrUDjc

(6). The Rise Of The Internet Of Things And The Economic Transformation Of The EU, Jeremy Rifkin, http://bit.ly/1DWYZxY

(7) Clayton Christensen on disruptive innovation, http://bit.ly/1KVtgO9

(8). The Battle Is For The Customer Interface, Tom Goodwin, http://tcrn.ch/1Ca9WHG